Table of Contents

How to Apply online HDFC Bank Millennia Credit Card Benefits , Use or Eligibility

HDFC Bank Millennia Credit Card Benefits : is a popular credit card designed specifically for millennials. Here are some key features and benefits:- 5% cashback on online spends, 1% cashback on offline spends, Rs 1,000 gift vouchers on spending Rs 1 lakh/quarter, 1% fuel surcharge waiver, Up to 20% dining discounts, Complimentary airport lounge access, Zero liability on lost cards, Interest-free credit period up to 50 days, Redeemable CashPoints against statement balance, flights, hotels, or products

Apply online HDFC Bank Millennia Credit Card Key Features:

- No annual fee for the first 5 years

- 5% cashback on online and offline spends

- 1% cashback on physical store spends

- Reward points on every spend

- Travel insurance and international assistance

- Exclusive events and special offers

- Personalized card with photo or design

- EMI options for 3, 6, or 12 months

HDFC Bank Millennia Credit Card Benefits:

The HDFC Bank Millennia Credit Card offers a wide range of benefits, including

- – 5% Cashback: Earn 5% cashback on platforms like Amazon, Flipkart, Myntra, Zomato, BookMyShow, Cult.fit, Uber, and Tata CLiQ.

- – 1% Cashback: Get 1% cashback on all other spends, including EMIs and wallet loads.

- – Gift Vouchers: Receive Rs 1,000 gift vouchers on spending Rs 1 lakh per calendar quarter.

- – Fuel Surcharge Waiver: Enjoy a 1% fuel surcharge waiver on transactions between Rs 400 and Rs 5,000.

- – Dining Discounts: Get up to 20% discount at partner restaurants with Swiggy Dineout.

- – Airport Lounge Access: Complimentary airport lounge access at select domestic airports.

- – Zero Liability: Avail zero liability on lost cards, ensuring you’re not held responsible for fraudulent transactions.

- – Interest-Free Credit Period: Enjoy up to 50 days of interest-free credit period from the date of purchase.

- – Rewards and Redemption: Redeem CashPoints against statement balance, flight/hotel bookings, or products from the HDFC product catalog.

These benefits make the HDFC Bank Millennia Credit Card an ideal choice for young professionals and millennials who want to earn rewards and enjoy exclusive privileges

HDFC Bank Millennia Credit Card Eligibility:

- To be eligible for the HDFC Bank Millennia Credit Card, you must meet the following criteria:

- Age: 21-60 years old

- Income:

– Salaried individuals: ₹25,000 per month

– Self-employed individuals: ₹3,00,000 per annum

- Credit Score: Good credit history (preferably 650+)

- Employment: Stable employment with a minimum 1-year work experience

- Residence: Resident of India

- ID Proof: PAN card, Aadhaar card, or other government-issued ID

- Address Proof: Utility bills, rent agreement, or other government-issued documents

- Income Proof: Salary slips, Form 16, or other income documents

Note: HDFC Bank may consider other factors like debt-to-income ratio, credit utilization, and repayment history while evaluating your application. It’s always best to check with HDFC Bank for the latest eligibility criteria and documentation requirements.

HDFC Bank Millennia Credit Card Documents Required:

To apply for the HDFC Bank Millennia Credit Card, you’ll need to submit the following documents:

- ID Proof:

- – PAN card

- – Aadhaar card

- – Passport

- – Driving License

- – Voter ID card

- Address Proof:

- – Utility bills (electricity, water, gas, or telephone)

- – Rent agreement

- – Passport

- – Driving License

- – Aadhaar card

- Income Proof:

– Salaried individuals:

- – Salary slips (last 3 months)

- – Form 16

- – Income tax returns (last 2 years)

– Self-employed individuals:

- – Income tax returns (last 2 years)

- – Balance sheet and profit & loss account (last 2 years)

- – Business registration documents

- Photo:

- – Recent passport-sized photograph

- Other documents (if required):

- – Proof of employment (appointment letter, employee ID card)

- – Proof of residence (lease agreement, society registration)

Note: HDFC Bank may request additional documents or information to process your application.

It’s recommended to check with HDFC Bank for the latest document requirements and to ensure you have all the necessary documents before applying.

How to Apply:

Applying for HDFC Bank Millennia Credit Card Online

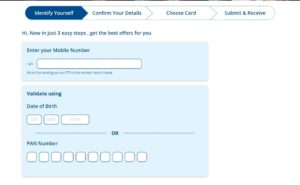

You can apply for the HDFC Bank Millennia Credit Card online through the HDFC Bank website . Here’s a step-by-step guide to help you through the process:

- Visit the HDFC Bank website: Go to the HDFC Bank website and navigate to the ‘Cards’ section.

- Choose the Millennia Credit Card: Select the Millennia Credit Card from the list of available credit cards.

- Check eligibility: Check if you’re eligible for the credit card by providing basic details like age, income, and employment status.

- Fill the application form: If you’re eligible, fill the online application form with required personal and professional details.

- Upload documents: Upload the required documents, such as ID proof, address proof, and income proof.

- Submit the application: Submit the application and wait for the bank’s representative to contact you for further verification.

- Get instant approval: If your application is approved, you’ll get instant approval and your credit card will be dispatched to your address.

Remember to always check the eligibility criteria and terms and conditions before applying for a credit card

HDFC Bank Credit Card Customer Care:

- Phone: 1800 202 6161

- Email: mailto:customer.care@hdfcbank.com

- SMS: TEXT to 5676712

हमारे WhatsApp Group Link को Join करें — Click Here

Telegram Group – Click Here

HOME Page

| Home | Click Here |

| Telegram Group | Click Here |